Reinsurance Consultant

Allemond is an Independent Reinsurance Consultant offering a range of specialist services, expertise and advice, providing support to start-ups, MGAs, Insurtechs, Brokers, ILS Funds, Insurers and Reinsurers

Services Offered

Reinsurance deal execution management

Drafting and technical review

Analysis, reviews and audits

Reinsurance and Underwriting processes

Independent underwriting peer review

Delegated underwriting and contentious recoveries

Reinsurance, Retro and ILS subject matter expert

Valued Clients Past and Present

ALAN GROVES, FCII Chartered Insurance Practitioner

Background

Experienced and versatile Reinsurance Consultant who has worked in the London and Bermuda markets performing a variety of management and transactional roles for Brokers, Companies, Lloyd’s Syndicates and MGA’s, playing a key role in the establishment and success of several start-up businesses linking traditional and ILS capacity to the original risk.

Professional Qualifications:

Fellow of the Chartered Insurance Institute

Chartered Insurance Practitioner Status

Winner of the CII Rutter Medal, awarded best new qualifying Fellow

ALAN GROVES, FCII Chartered Insurance Practitioner

ALAN GROVES, FCII Chartered Insurance Practitioner

Background

Experienced and versatile Reinsurance Consultant who has worked in the London and Bermuda markets performing a variety of management and transactional roles for Brokers, Companies, Lloyd’s Syndicates and MGA’s, playing a key role in the establishment and success of several start-up businesses linking traditional and ILS capacity to the original risk.

Professional Qualifications:

Fellow of the Chartered Insurance Institute

Chartered Insurance Practitioner Status

Winner of the CII Rutter Medal, awarded best new qualifying Fellow

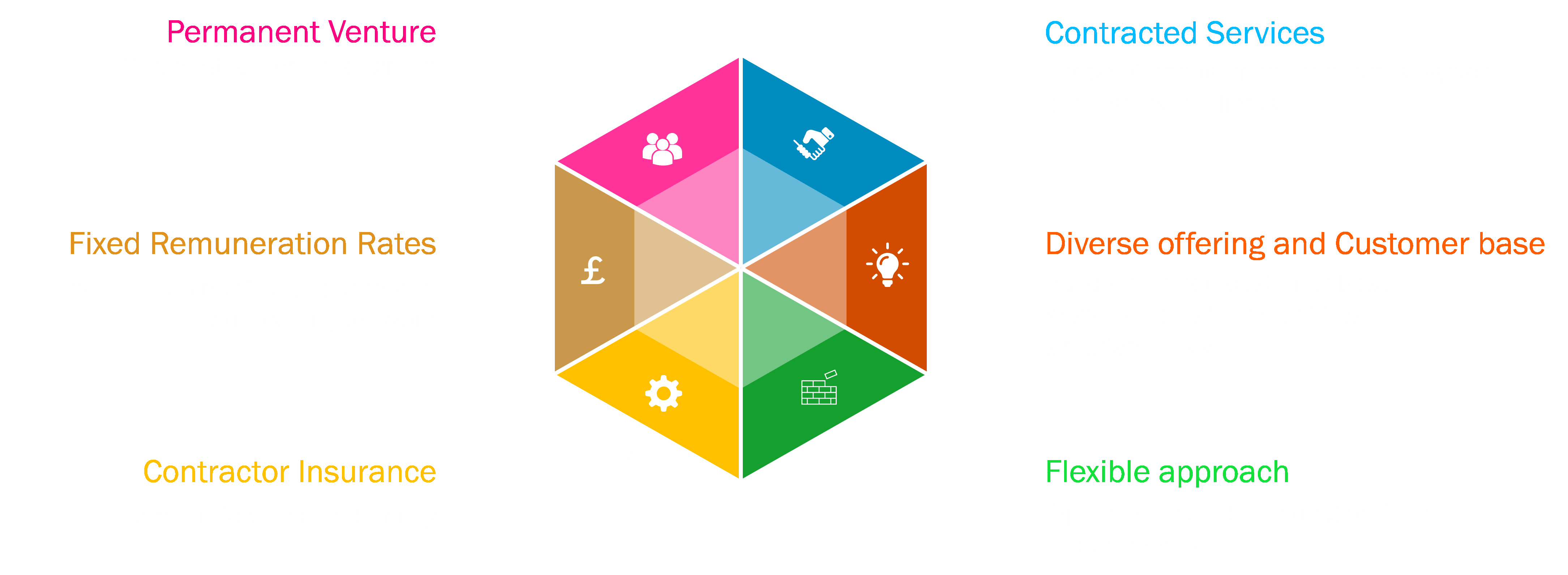

Client Focussed Business Model

Flexible approach to managing Client requirements

Confidentiality provisions agreed and contracted at outset

Work completed remotely or on-site using Client’s own systems

Conflicts managed through limiting overlaps and open disclosure