Can Collateralised Re win back investors?

6 Minute Read

My goal in approaching blog writing has been to focus on areas of the industry that could perhaps be improved, I also find it fascinating to follow market trends and developments and it was good to see some of my thoughts on the current reinsurance market conditions re-affirmed by speakers at the Artemis London Conference last week, my thanks to them for some of the points detailed in this post.

Having spent a lot of time in my career working in the Property Reinsurance and Retro markets, I have been lucky enough to have worked for and with some good people who were always ready to experiment and try new ideas and approaches, this enabled me to gain experience and exposure working with new products – ILW’s and CBOT in the 1990’s, Collateralised Re and Cat Bonds in 2000’s and some of the Pillared Cat products in the 2010’s.

Innovation and new product design is usually a necessity driven reaction to counterbalance supply and demand dynamics when the market becomes constrained or distressed. About a once in a decade occurrence during my career, most notably following the major loss events of Hurricane Andrew, 1992, World Trade Centre, 2001 and Hurricane Katrina in 2005.

Current Market Conditions

It is not difficult to see that buyers of catastrophe exposed reinsurance products are currently going through a tough time, capacity is constrained, and the pivotal Florida Property Cat renewal season displayed plenty of signs of distress that will likely be a bellwether of what is to come in 2023.

To recap some of the key outcomes:

- Citizens (Reinsurer of last resort) was only able to secure $2.5Bn of the $4.7Bn of the coverage sought

- Florida Office of Insurance Regulation entering into a temporary reinsurance arrangement with Citizens to protect policyholders and keep additional policies out of Citizens

- Insurers were unable to complete their orders, especially at the lower end of the risk tower

- Rating firm Demotech issued downgrade notices to 17 companies, later downgrading 2 following widespread pressure

(Insurance Insider, 2022)

Difficult Florida renewal seasons are not a new phenomenon, it is an insurance market with huge catastrophe exposures and a relatively fragile capital base, there is a heavy reliance by Insurers on reinsurance protection to meet solvency requirements. Therefore, it is not unusual for this particular segment of the market to go through a distressed period, except perhaps on this occasion there has not been a major loss event for 4 years.

It is a playbook that is being repeated in other cat exposed regions in the USA and in all corners of the world where buyers have faced difficulty securing capacity for low level layers at any price, even in markets where results have been good, and capacity is has been previously supplied in abundance.

Prior Decade Development

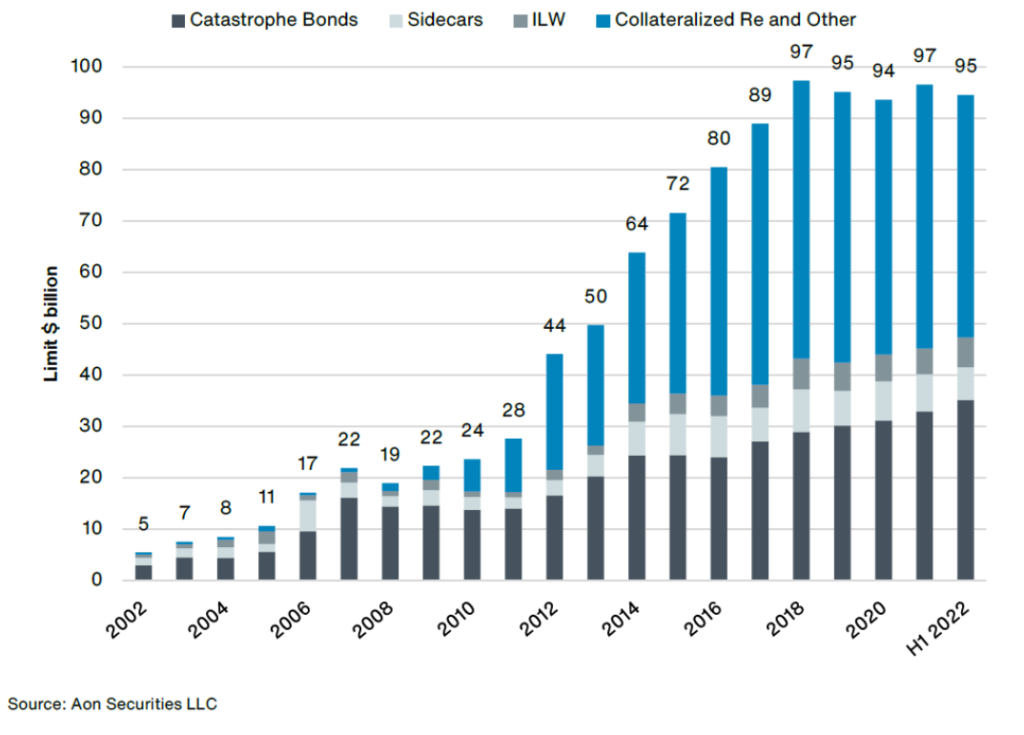

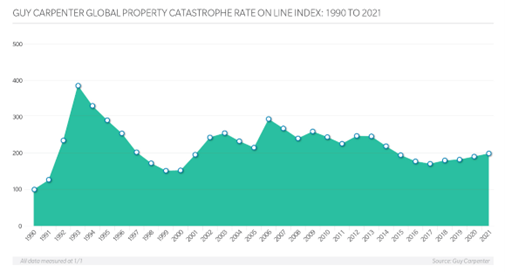

The following exhibits, while subjective, tell a typical story of how ILS capital inflows have impacted the market during the period 2011 to 2018, we have seen dramatic growth in the supply (from $28 to $97Bn) complimented by a fall in price as demonstrated in the Guy Carpenter ROL Index below.

(Aon Securities LLC, 2022)

Cat Bond issuance has increased steadily YoY during this period as have ILWs, with the steeper gains made in the Collateralised Re and Sidecar areas.

The period from 2018 to 2021, also saw a string of losses impact the Collateralised Re sector, Hurricane Irma, US wildfire and tornado events, European Floods, Winter Storm Uri and Covid-19 fuelled by a combination of climate change and increasing social inflation. Even where these events did not directly cause losses, they served to trap collateral needed to support renewals and reinvestment, which is an inefficient use of capital from an investment perspective.

Cat Bonds on the other hand largely escaped any impact from the smaller loss events, hence their development has continued unabated during the loss impacted period while Collateralised Re and Sidecars have contracted, generating a price recovery to 2013 levels in the ROL index.

Impact of Weakening Conditions

2011 to 2018 was without doubt a buyers’ market, what the graphs cannot show is the slippage in terms and conditions experienced in Collateralised Re products, neither do they show the impact on the Retrocession market; a much smaller but important market given that many Reinsurers rely on the Retrocession programmes to help shape their underwriting strategy.

The Retro market is an area with opaque data and greater volatility, where capacity changes (as well as losses) are amplified in comparison to the Reinsurance space. So, while it generates superior returns, the volatility and data constraints mean that it tends to be approached with caution by ILS investors.

The proliferation of Pillared and Aggregate Products in the Collateralised Re sector during this period served to lower retentions and changed the purchasing motivation of buyers from one of capital preservation to results protection, or perhaps more cynically, bonus protection.

Lowering attachments and the spread of loss coverages in combination with increased frequency of loss events and social inflation has exposed ILS Investors to unexpected losses – Investors were sold on hurricanes and earthquakes and have been delivered wildfires and pandemics.

Flight to Quality

The consequence of a loss of confidence in Collateralised Re products has led to a flight to quality across the different market sectors.

While the amount of capacity dedicated to ILS has remained static in recent years, this has been underpinned by the growth of the Cat Bond sector while Collateralised Re has retracted.

Investors have a far greater understanding of the insurance space than they did 15 years ago, experience has replaced naivety and dedicated insurance investment professionals have spent their whole career working in the sector. Insurance as an asset class is attractive to investors. It is an uncorrelated investment in comparison to other asset classes, remains largely unaffected by movements in the wider equity markets and economy, representing a very low systemic risk.

The reaction of Investors to the current market conditions appears to be a realignment of interests into investments that provide greater clarity of coverage, certainty in outcomes and remoteness of risk. Features that are generally held by the Cat Bond product:

- Tend to sit at the top of the risk tower and is less susceptible to smaller cat losses

- More commoditised than Collateralised Re with defined perils and coverage

- High level of data granularity and clarity of information and portfolio exposure

- Independent verification of modelled losses and claims

- Most Cat Bonds are tradable on the secondary market, providing some element of liquidity

Therefore, it appears that in terms of ILS investment, Cat Bonds are in-vogue and are stealing market share from Collateralised Re, although the actual situation is more nuanced. This is because Cat Bonds and Collateralised Re are complementary products rather than competing, buyers cannot necessarily utilise a Cat Bond purchase to make a straight replacement for deficiencies from Collateralised Re products in their traditional reinsurance programme because:

- Cat Bonds can be time consuming and costly to arrange

- Cat Bond issuance requires underlying portfolios of size and scale

- A high level of data granularity and clarity is required, often not attainable for Retrocessionaires or Reinsurers with a high level of delegated interests

- Replacing low level protection with higher attachment changes the retained risk profile and financial mechanics

Additionally, there are other factors at play that are impacting the capacity crunch. Equity markets have responded by withdrawing credit (in terms of price valuation multiple) to companies that hold material exposure to excess property, i.e. catastrophe exposed insurance and reinsurance businesses.

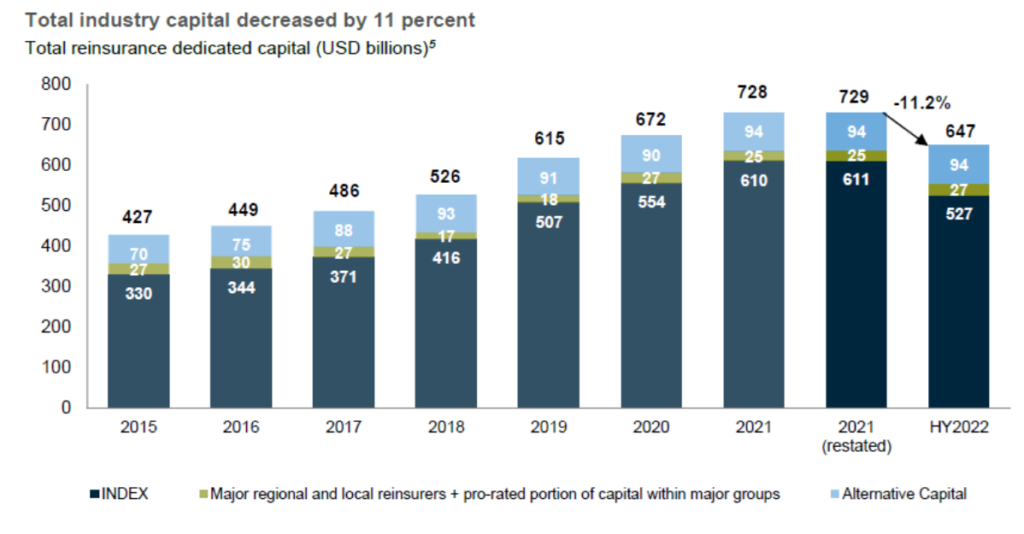

Consequently, several large, high-profile reinsurers have shifted underwriting strategies away from cat exposed reinsurance business and creating the largest retraction in reinsurance capacity seen in years, estimated at 11.2% in 2022 by Gallagher Re below, (although in fairness about half of this amount is attributable to investment losses):

Impact of Weakening Conditions

A scarcity of Retro Capacity and increasing retentions for Reinsurers will generally force changes in underwriting strategy for buyers, usually by reducing participations to more risk exposed layers and exiting poorly performing business or by exiting the business line altogether.

The knock-on effects will spell trouble for Insurers, particularly in some territories where regulators insist on capital levels which mean that they are reliant on their reinsurance programme to secure an “A” range rating but are also constrained by the regulator (as in the USA) from readily passing on increased protection costs to consumers.

Ultimately the underlying cause of the issues for the Collateralised Re product are related to structure and coverage, the solutions for Insurers and Reinsurers could be a combination of the following:

- Price increases will greatly benefit those who can stand firm and continue to service clients however, these alone are unlikely to retain or win back investors and will probably be short-lived. At the current time, price increases appear to have only returned to 2013 levels and clearly do not consider the changing underlying risk (climate and demographic changes), economic inflation and the loss amplification factors of social inflation and supply chain issues of recent years

- Narrow coverage terms by limiting coverage to named covered perils and specific territories or regions

- Increasing retentions moving Reinsurers and Retro carriers away from the loss

- Seek out alternatives such as ILW purchases, innovate new Treaty product design or buy more facultative cover to remove peak exposures

- Adjust the capital structure reconfiguring balance sheets and refinancing to enable greater retention of risk

- M & A combining resources to create larger entities able to absorb losses and reduce reliance on reinsurance coverage

It is clear that in order to attract capacity back to the Collateralised Re sector, there will need to be a product evolution that meets the desired investment criteria, creating a commoditised and tradable solution that provides investors clarity of coverage and greater liquidity in their investment, without the prospect of trapped collateral.

Without product innovation it is likely that capital will continue to seep away and capacity in the Collateralised Re sector will reduce further, increasing prices and changing the financial dynamics of Insurers, the cost of which will ultimately be passed to consumers.

Allemond Ltd

Allemond Ltd is an independent Reinsurance Consultant offering a range of specialist reinsurance services and expertise, providing support to start-ups, MGAs, Insurtechs, Brokers, ILS Funds and Reinsurers.

Follow Allemond on Linkedin to find out more learn more about our offering and progress. Allemond Ltd: Overview | LinkedIn